When you purchase through links on our site, we may earn a commission. Here’s how it works.

| 1st |

|

| 2nd |

|

| 3rd |

|

| Compare All Products | |

Making sure your employees get paid correctly and on time doesn’t have to be a headache. Online payroll services make it a painless part of running your small business efficiently.

Article Overview

- Best Payroll Solutions

- Comparison Table

- Other Payroll Software Reviews

- Is It Time To Rethink Your Accounting Software?

What’s The Best Payroll Software For Small Business?

All of the payroll accounting software reviewed here is online, so there’s nothing to download or install. All of the services we’ve included in this comparison also give you plenty of mobility—you can easily run payroll online from your smartphone or tablet while you’re on the go.

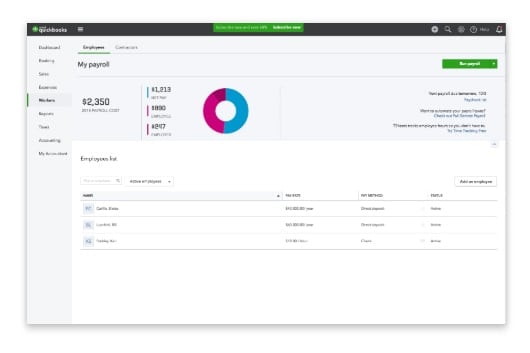

Winner: Intuit QuickBooks Payroll Review

Intuit QuickBooks’s payroll service takes our top spot for the best payroll software for small businesses. They offer all the features you’ll need at three different pricing tiers. The payroll services are an add-on service to QuickBooks’ popular accounting software (an extra-base price per month and four plans to pick from depending on how many users and features you need). Paying for both services may seem like overkill, but you get a ton of value and bang for your buck (and competitive pricing).

Another reason they are our number one pick is that Intuit is a trusted leader in the accounting software space offering tax and inventory management services in addition to accounting and payroll. So you can manage all your finances under one umbrella.

The only downsides we found? They don’t offer live tech support on weekends. However, they are available 12 hours each weekday (and who does payroll after-hours anyway?). Also, QuickBooks Payroll is not compatible with QuickBooks Mac (will need to use Intuit Online Payroll’s add-on instead).

Pros |

Cons |

|

|

Pricing

Try Intuit QuickBooks Payroll before you buy with the 30-day free trial. For a limited time, get a 50% discount for your first 3 months.

| Core | Premium | Elite | |

|---|---|---|---|

| Price Per Month | $45 | $75 | $125 |

| Additional Employee Cost (Per Employee) | $4/month | $8/month | $10/month |

| Direct Deposit | Next day | Same day | Same day |

How Does Intuit Payroll Work?

See how Intuit helps a restaurant owner with 15 employees simplify her payroll management.

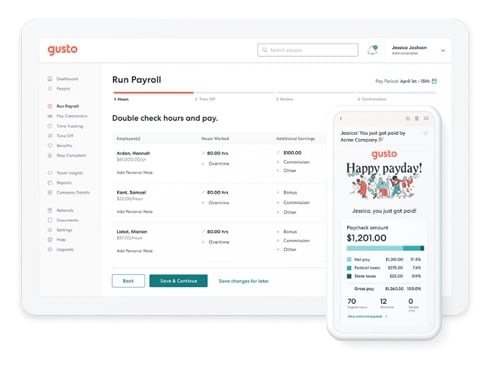

Runner-Up: Gusto Review

Gusto comes in a close second behind Intuit QuickBooks Payroll in our battle of online payroll solutions. A relative newcomer, Gusto has made a real name for itself since its 2011 launch. Once you get into Gusto, it’s easy to see why. The simple yet modern interface is easy to set up and maintain, and their employee portal is the best we’ve seen.

Gusto offers everything you’ll need for a small business to manage payroll and related tax filings in their base price, including year-end filings, pay-as-you-go workers’ comp, compliance management, health benefits administration, and much more (most other services charge added fees for these features).

Pros |

Cons |

|

|

Pricing

Gusto offers a 30-day free trial so you can try before you purchase.

| Core | Complete | Concierge | Select | |

|---|---|---|---|---|

| Base Price/Month | $39 | $39 | $149 | Contact sales |

| Per Employee/Month | $6 | $12 | $12 | Contact sales |

3rd Place: SurePayroll Review

SurePayroll, now owned by Paychex, is one of the oldest online payroll manager services around. SurePayroll has kept up with the times—they’re among the quickest online payroll processing services we’ve seen.

They also offer full-service payroll tax filing with their monthly pricing and hold multiple industry awards for excellent customer service. If you’re looking for more services, SurePayroll offers a few add-ons, including 401(K), Health Insurance, Workers Comp.

Pros |

Cons |

|

|

Pricing

SurePayroll offers a 30-day free trial.

- Self Service: $19.99 per month +$4 per employee per month

- Full Service: $29.99 flat rate per month +$5 per employee per month

- Time clock integration: $4.99 per month + $3 per employee per month

- Accounting integration: From $4.99 per month

Comparison Table

See our side-by-side table to help you compare all of our reviewed online payroll software features, pricing, and more. *In this table, monthly pricing is an estimate for a small business with 10 employees being paid at a semi-monthly rate.

Some of the companies we reviewed have base rates and an added fee per month per employee; some give you an instant quote based on the number of employees and the frequency of payroll runs. We created the monthly estimate so you can best compare pricing across the board.

| Winner: QuickBooks | 2nd Place: Gusto | 3rd Place: SurePayroll | ADP Payroll | BenefitMall | OnPay | Paychex | Sage Payroll | Square Payroll | |

|---|---|---|---|---|---|---|---|---|---|

| Winner: QuickBooks | 2nd Place: Gusto | 3rd Place: SurePayroll | ADP Payroll | BenefitMall | OnPay | Paychex | Sage Payroll | Square Payroll | |

| Base Monthly Price* | $45 | $39 | $19.99 | Contact ADP | $186.51 | $76 | Contact Paychex | $49.95 | $79 |

| Base Price Per Employee Per Month | $4 | $12 | $4 | Contact ADP | $11.50 | $4 | Contact Paychex | $4.99 | $5 |

| Out-of-State Tax | $12 | $0 | $0 | $0 | $0 | $10 | $0 | Unlisted | $0 |

| Free Trial | 30 days | 30 days | 30 days | None | None | None | None | None | None |

| Hourly, Salary & Contracted Pay | |||||||||

| Unlimited Pay Runs Per Month | |||||||||

| Direct Deposit | |||||||||

| In-House Check Printing | |||||||||

| PTO Accrual | |||||||||

| Payroll Deductions | |||||||||

| Reporting | |||||||||

| Employer Contributions | |||||||||

| Wage Garnishments | |||||||||

| Employee Portal | |||||||||

| New Employee Reporting | |||||||||

| Automatic Payroll Taxes | |||||||||

| End Year Tax Filing | Added fee | Added fee | Added fee | Added fee | Added fee | ||||

| Mobile Apps | |||||||||

| Accounting Software Integration | |||||||||

| 24/7 Tech Support | |||||||||

| Dedicated Account Specialist | Added fee | Added fee | Added fee |

Other Contenders

The following payroll companies didn’t make our top three, but you may discover a service that fits your needs. Click on a link below to jump to that review.

ADP Payroll Review | BenefitMall Review | OnPay Review | Paychex Flex Review | Sage Payroll | Square Payroll

ADP Payroll Review

ADP is one of the most popular and well-known services for workforce management, including payroll services online. They offer three plan levels, Essential, Enhanced, and Complete Payroll+HR. When comparing these levels to other best online payroll services we’ve reviewed, the features of their Enhanced plan more closely match what other services offer.

ADP’s pricing is higher than most services in our reviews (even their lowest plan). ADP is a reliable, strong contender in online payroll, but its high cost may deter small businesses looking for more affordable options with a robust set of features. If your business is mid-sized, however, you should consider ADP.

Pros |

Cons |

|

|

Pricing

You must contact ADP Sales to get a price quote for your small business. They do offer 2 months free when you sign up for a payroll plan.

BenefitMall PayFocus Review

BenefitMall is a service with a strong focus on human resources and workforce management. This online software, PayFocus + HR Software, gives small businesses a combination of payroll processing and human resources services.

They offer three payment tiers, including the option of PayFocus Full Service, where your account specialist takes processing off of your hands.

BenefitMall bases its pricing per payroll for weekly, bi-weekly or monthly cycles. With pricing on the high side, even for their basic plan, it can get pretty expensive depending on your needs. But if you’re looking for payroll and more specialized HR assistance, BenefitMall is a solid choice.

Pros |

Cons |

|

|

Pricing

BenefitMall’s pricing differs from other services — their monthly charges differ based on the frequency of your pay cycles per month.

-

-

- $115.06/month (based on 10 employees and monthly pay cycles)

- $186.51/month (based on 10 employees and bi-weekly pay cycles)

- $302.80/month (based on 10 employees and weekly pay cycles)

- View all options

-

OnPay Review

OnPay is a simple yet sleek and affordable online payroll service best geared toward small- to mid-sized small businesses. You’re not going to find many add-ons with OnPay, but that’s not their niche. They offer solid, unlimited payroll cycles each month, and they do all the payroll tax forms for you (including filing), with no additional fees.

Pros |

Cons |

|

|

Pricing

Your first month is free with OnPay.

-

-

- $36 per month

- $4 per month per employee

-

Paychex Flex Review

Paychex, the parent company of our number three pick SurePayroll, has been an industry-leading payroll, human resources, and benefits outsourcing company for several decades. Its Paychex Flex online payroll service is a solid, reliable choice for businesses of all sizes

This service, however, tends to be more expensive for smaller-sized businesses than many other payroll services we’ve reviewed here—and with a few missing features (most notably, you can’t run unlimited payrolls each month, and you can’t print checks in-house).

If you have the budget, definitely look into Paychex Flex. They offer 24/7 customer support and a dedicated specialist.

Pros |

Cons |

|

|

Pricing

You have to contact Paychex for an individual price quote.

Sage Payroll Review

Sage is a popular accounting and HR platform that also provides separate payroll services. Sage Payroll Essentials Plus gives you unlimited processing, tax filing, and direct deposit for up to 10 employees — at a low $49.95 per month fee.

Their other option is Payroll Professional, a fully-managed service for businesses with more than 10 employees. You can also add to Sage’s accounting and HR management software, which includes timekeeping, ACA compliance, recruiting, and more.

Although the price is right, Sage Payroll’s clunky and outdated interface makes the payroll process more difficult than other platforms we review here. Several users also say that it lacks advanced functionality that larger organizations need.

Pros |

Cons |

|

|

Pricing

Sage Payroll Essentials Plus

- $49.95/month up to 10 employees

Full-Service Payroll

Square Payroll Review

Square, a major player in the POS (point-of-sale) and online credit card processing industries, is also a solid contender as an affordable, cloud-based payroll software — especially if you’re already using it for your retail or restaurant business.

Square Payroll gives you automatic tax filings, time and PTO tracking, direct deposit, new-hire reporting, worker’s comp, and much more without any added fees. If you only pay contractors, they only charge you $5 per contractor per month (with a $0 base price), which includes 1099-MISC processing and filing.

You’re not going to find many bells and whistles with Square Payroll, but if your small business has basic payroll processing needs, Square is certainly worth consideration.

Pros |

Cons |

|

|

Pricing

- $29 per month base price

- $5 per employee per month

- View all options

When Is It Time To Switch Your Accounting Software?

Payroll software is only one piece of the accounting pie. As your business grows and adapts to new technologies, you may need some of the new cutting-edge features offered by new entrants in the accounting software space, or you may realize you’ve been paying too much. Find out who’s best and why in our comprehensive review of the best small business accounting software.

If you are involved in retail shares, you may also be interested in our coverage of POS systems and online payment processing services.

Tagged With: Reviews